Contents:

There are quite a few platforms in which traders can obtain free trading signals. Free trading signals can actually be no different to paid trading signals. Service providers such as AtoZ Markets still offer free trading signals in real time. That means the data is relevant right now and traders can act upon those signals immediately. A free forex trading signal is provided for no charge.

In scalping, the core part is to identify the market phase. The trading system for a range market will not work in a strong trending market. But the good news is that we can earn money from scalping, both the trending and ranging markets. Let’s take a closer look at some of the pros and cons of forex scalping strategies. Observe your risk-management guidelines strictly and exit trades shortly.

Final Word On Scalping Forex

Bear in mind to trace exercise inside a day and function large-volume intervals of buying and selling classes. Don’t rush to position orders earlier than the value hits the extent. Till then, orders might be rearranged or “disassembled” by orders positioned on the opposite facet.

- Also, it’s inECN live accounts that orders are executed the fastest.

- Forex scalpers typically look for a cross between the Stochastic Oscillator and its signal line to identify a potential trade opportunity.

- Slippages and unexpected spread increases are an unpleasant force majeure circumstance for a scalper.

Heiken Ashi is a particular sort of candlesticks visualized in a extra handy approach and making a handy development change alert. It has a value calculation method based mostly on an open-high-low-close chart , completely different from traditional candlesticks. The crossover of the black and violet strains is a sign for opening a commerce. Will probably be held till the primary crimson candlestick kinds. Do not shut a commerce if the value solely handed the center of the channel. In level 8, the value touched the center of the channel and went down.

What is Scalping?

Be sure to make use of free trial https://traderoom.info/s to increase the number of free signals available to you. Some trading signal providers will provide signals on different platforms throughout the day, so frequently observe all of them. Another TradersBest tip is to set up notifications if a trading signal group or app releases a free signal. However, some free trading signals – such as those provided by AtoZ Markets – are complete signals.

To hone your craft on a particular instrument allows you to achieve a better understand of it. At GoldSignals.io they have done exactly that; a deep knowledge and consistent trading style allows them to achieve a high success rate that rivals most signal providers. On the other hand, if you were a scalper, you can easily get off the market with a minimum loss. No scalping trading system uses more than pips of stop loss. Therefore, no matter how the broader market moves, reducing the loss at a minimum level is essential, which is possible with scalping.

https://forexhero.info/ scalpers tend to focus on 1-minute or 5-minute price charts. It’s very rare that a scalper will monitor charting time frames that are longer than 15 minutes. Starting with trading signals providers is a good way of understanding the market and how FX pairs fluctuate over time. Expert traders can get the confirmation they were looking for if they follow these channels. Traders don’t have to sit in front of their screens to execute their forex scalping strategy for once. They don’t have to manually scan all the pairs and look for the correct signals to enter the markets.

Grid Scalping

There are different strategies on which the scalping forex signals are based on, such as technical indicators. Some indicators used for scalping include moving averages, stochastic, support and resistance levels, trend lines etc. But scalping and short-term signals are also based on fundamentals such as data releases, economic news, speeches from central bankers or political events and comments. We use all these indicators, both technical and fundamental for our forex signals. You can find out more about the strategies we use in theforex trading strategy section. If you have been following our signals service you may have seen how profitable forex scalping and short-term forex signals can be.

The simple definition is that forex scalping is where traders aim to skim profits from small price movements across a large number of trades. Contrary to other forms of trading, the main goal of scalping forex is to accumulate multiple small wins over a few seconds to minutes, as opposed to a few larger winners over days or weeks. With a live account, our traders have access to our online chart forums. These are updated regularly with market news and analysis from professional traders of the platform, so you can share ideas and take influence from others’ success with forex scalping strategies. There are multiple moving average lines on a typical forex graph.

Best Forex Brokers For Scalping in 2022 – FX Leaders – FX Leaders

Best Forex Brokers For Scalping in 2022 – FX Leaders.

Posted: Thu, 01 Sep 2022 20:10:58 GMT [source]

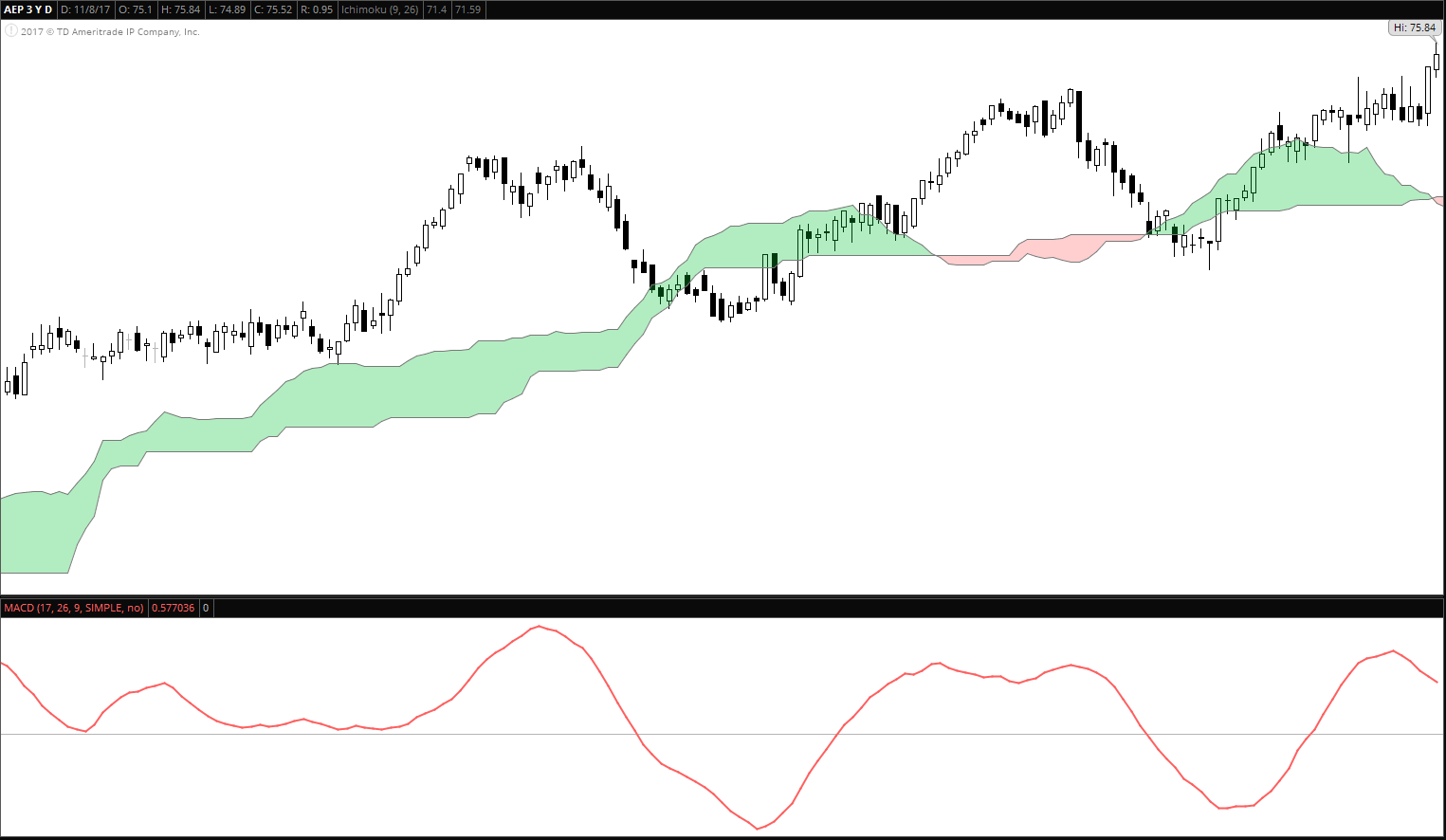

Or it may start during a temporary balance of bulls and bears power. The https://forexdelta.net/ scalping strategies of this kind suggest that you identify the beginning of a trend on the time frame of H1-H4 by means of a trend indicator or a confirming oscillator. Next, you analyze the market conditions and look for signals on the time frame M5. A practical example of this scalp Forex strategy will be explained a little later. Forex scalping strategies are quite popular with beginner day traders. High-frequency trading allows taking quick real-time profits and avoiding swaps.

Thus, when two of the major forex centers are trading, this is usually the best time for liquidity. The Sydney and Tokyo markets are the other major volume drivers. Platform mistakes and carelessness can and will cause losses. Practice using the platform before you commit real money to the trade. Scalpers enter and exit the market quickly, making several small trades in the hopes of achieving profits from relatively small price changes over and over again. In the investment world, scalping is a term used to denote the “skimming” of small profits on a regular basis, by going in and out of positions several times per day.

- Indicators such as the Smooth Moving Average , Bollinger bands, Stochastics, and Relative Strength indicator are amongst the most popular indicators used to provide scalping signals.

- It’s worth knowing that scalping is not allowed at some forex brokers, so make sure to eliminate these first.

- But, most retail traders have day jobs and the only time they can trade is when they come home from work at 6-7 pm.

- In order to execute trades over and over again, you will need to have a system that you can follow almost automatically.

- In scalping, a day trader manages to have on almost every price change in both directions small gains, while in intraday trading, part of the profit is “lost” due to pullbacks and corrections.

Whilst signals can be a useful tool, they don’t suit everyone and their reliability is not guaranteed. Moreover, you cannot really be sure which signals you can trust, since they are provided by other traders. Unfortunately, the signals market is rife with traders who claim to offer the best forex scalping strategy with ‘90% wins’ via their signals.

Well suited for work, both scalpers and medium-term traders. After setting the currency pair on the chart, you will see that below the price, there will be levels for purchases, and above the price, there will be sales. Scalping is one of the trading styles, the essence of which is to profit from small price fluctuations over a short period. Typically, scalpers (the so-called traders who practice this method) close the deal quickly enough after it has become profitable. This trading style involves a large number of transactions in a short time, for example, more than 100 intraday transactions. Trading signals are designed to be alerts to trigger a certain action such as buying or selling a particular currency pair.

Choices must be made in lower than a minute as a result of Foreign exchange scalpers hunt for a revenue of just some factors. Allow us to see the way to commerce repeated typical actions and streaming knowledge utilizing orders and pending orders. Forms of Foreign exchange scalping methods based mostly on technical methods.Scalping with evaluation of a number of time frames. Such a technique is used when buying and selling a short-term development.

Don’t open multiple positions if the gap between the two conditions is two or more candlesticks or if MAs converge and then diverge instead of crossing each other. You can close the trade ahead of time in point 3, or you can squeeze the maximum out of the trade. Open a tradeprofitably in the price movement direction. Risk management rules are often neglected and don’t exit trades quickly. A trader can open dozens of trades in various assets simultaneously, trying to exploit every small price fluctuation.

If the hole between the 2 situations equals one candlestick, you’ll be able to open a commerce, however such a sign is taken into account as lagging. Do not open a number of positions if the hole between the 2 situations is 2 or extra candlesticks or if MAs converge after which diverge as an alternative of crossing one another. To scalp Foreign exchange, you need to use common technical indicators. Do not maintain a number of positions for too lengthy. Then open a commerce in an other way or take a pause.